A confusing headline for a confusing market. Gold in the long term is heading up. It may even be a shelter for the turbulent times coming in Europe. There is a fight to keep countries like Greece in the Euro. This in turn leads to some opinions that Gold will be a safe haven. The activities of the FED have led to a belief another stimulus is likely that will lead to an up on the price. However, others think it won't be enough , hence the bears. See the Reuters report below to get an angle.

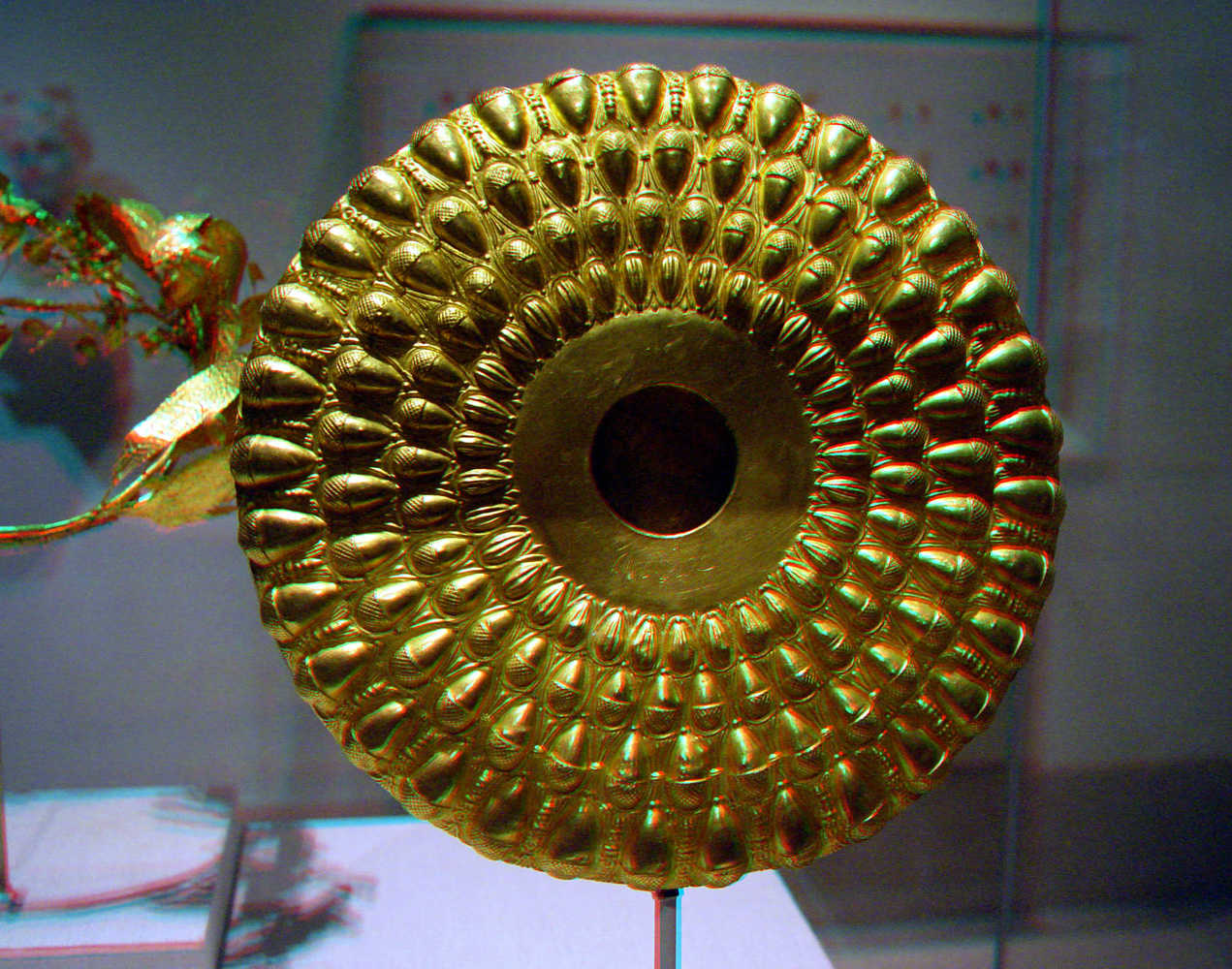

Image Source:www.anachrome.com via wikicommons.

Gold options show investors bracing for Fed let-down

"Options on shares of the SPDR Gold Trust, the world's largest exchange-traded fund backed by physical gold, that expire on September 22 also show investors have cut back on bullish plays. Open interest in calls on SPDR shares priced at $166.0, which …"

http://www.reuters.com/article/2012/08/24/us-markets-gold-options-idUSBRE87N0FV20120824

Who knows what the future wiil bring. Long term Gold still seems to have it's lure.